Part I: How to Protect Your Small Business…

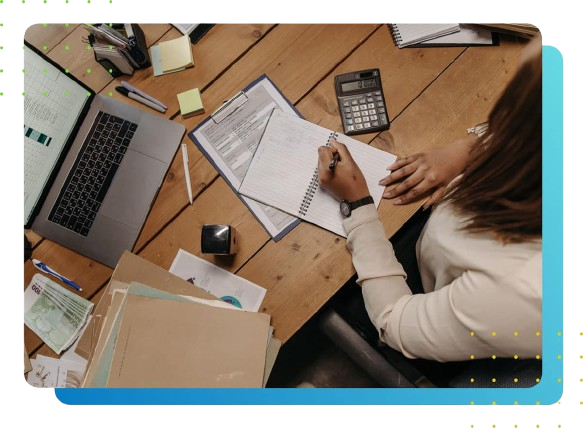

Running a small business can be both rewarding and challenging, especially when it comes to managing your taxes. As a…

Running a business is challenging, and managing your books, meeting tax deadlines, and navigating IRS issues shouldn’t add to the pressure. Whether you’re looking for peace of mind, planning ahead for tax savings, or dealing with an unexpected IRS notice, I’m here to open the door to a more confident, stress-free financial experience.

At OpenDoor Tax & Accounting, I provide expert virtual accounting and tax services tailored to individuals, entrepreneurs, and small to mid-sized businesses, no matter where you're located. With about 20 years of experience in public accounting, private industry, and the IRS, I offer personalized support in bookkeeping, tax compliance, strategic tax planning, and IRS representation — so you can stay focused on what matters most: growing your business.

Founder of OpenDoor Tax & Accounting

“Big firm experience. Solid educational background. One-on-one support.”

Hi, I am Michelle, Founder of OpenDoor Tax & Accounting. With about 20 years of hands-on tax experience, I’ve had the privilege of working at some of the most respected accounting firms — EY, KPMG, and Andersen — and serving as a Revenue Agent with the IRS. My experience covers a wide range of clients, from partnerships, S-Corps, and C-Corps to high-net-worth individuals. I’ve helped clients in industries such as real estate, private equity, financial services, and family offices, guiding them through complex tax issues with confidence and clarity.

I hold a Bachelor’s degree in Business Administration with a focus in Accounting, and a Master’s in Business Taxation from the University of Southern California (USC). This combination of solid education and extensive real-world experience equips me with a deep understanding of both accounting principles and U.S. tax law.

Ready to get started?

Let’s open the door to organized bookkeeping, better tax compliance, smarter tax planning, and real financial confidence, together.

Schedule your free consultation now!

At OpenDoor Tax & Accounting, we offer accounting and tax services that help small to medium-sized businesses, entrepreneurs, and individuals navigate their financial journey. Here’s how we can assist you:

We build and manage customized bookkeeping systems in QuickBooks Online to ensure accurate financial records and better business decision-making.

We operate as your in-house tax team, delivering complete workpapers and partnership tax returns for smooth collaboration with your external CPA firm.

We provide expert tax return preparation and proactive planning to help you minimize liabilities, stay compliant, and make informed financial decisions year-round.

We provide professional IRS audit representation, managing all communication and guiding you through every step of the audit or tax notice response process.

A small river named Duden flows by their place and supplies it with the necessary regelialia. It is a paradise

At OpenDoor Tax & Accounting, we specialize in providing tailored accounting and tax services to a variety of industries, ensuring each client receives expert support for their unique needs:

Stay informed with the latest tax tips, accounting best practices, and industry insights from the experts at Opendoor CPA.

Running a small business can be both rewarding and challenging, especially when it comes to managing your taxes. As a…

In our first post, we talked about the IRS audit red flags you should watch out for. But knowing the…

Managing your business finances doesn’t have to be complicated! Whether you’re just starting out or have been in business for…

Hear from the businesses and individuals who have trusted Opendoor CPA for their tax and accounting needs

Let’s discuss how we can streamline your accounting, ensure compliance to reduce IRS audit risks, optimize your tax strategy, and provide support during the audit process. Book a free 20-minute discovery call today!

We’re here to make tax and bookkeeping simple, with personalized solutions designed to help you stay on top of your finances and confidently meet compliance needs.

©2025.opendoorcpa. All Rights Reserved. Developed by FROZEWEB